charitable gift annuity minimum age

Our minimum age for a payment. Find out how you can generate a tax-deductible income in retirement by donating to your favorite charity with a Charitable Gift Annuity.

Charitable Gift Annuities Giving To Stanford

In exchange the charity assumes a legal obligation.

. When you establish a charitable gift annuity by gifting cash or stock to Child Evangelism Fellowship you will receive an immediate tax. Charitable Gift Annuities. With a minimum gift of 20000 you will receive a fixed annual.

When you establish a charitable gift annuity for Oblate School of Theology through the Oblate Annuity Trust you will receive fixed payments for life minimum age 59 ½ Your regular. A charitable gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities. With a minimum contribution of.

Ad Support our mission while your HSUS charitable gift annuity earns you income. A charitable gift annuity CGA is a contract in which a charity in return for a transfer of assets such as say stocks or farmland agrees to pay a fixed amount of money to. New Look At Your Financial Strategy.

Visit The Official Edward Jones Site. You will incur no costs to establish the arrangement and no. Find a Dedicated Financial Advisor Now.

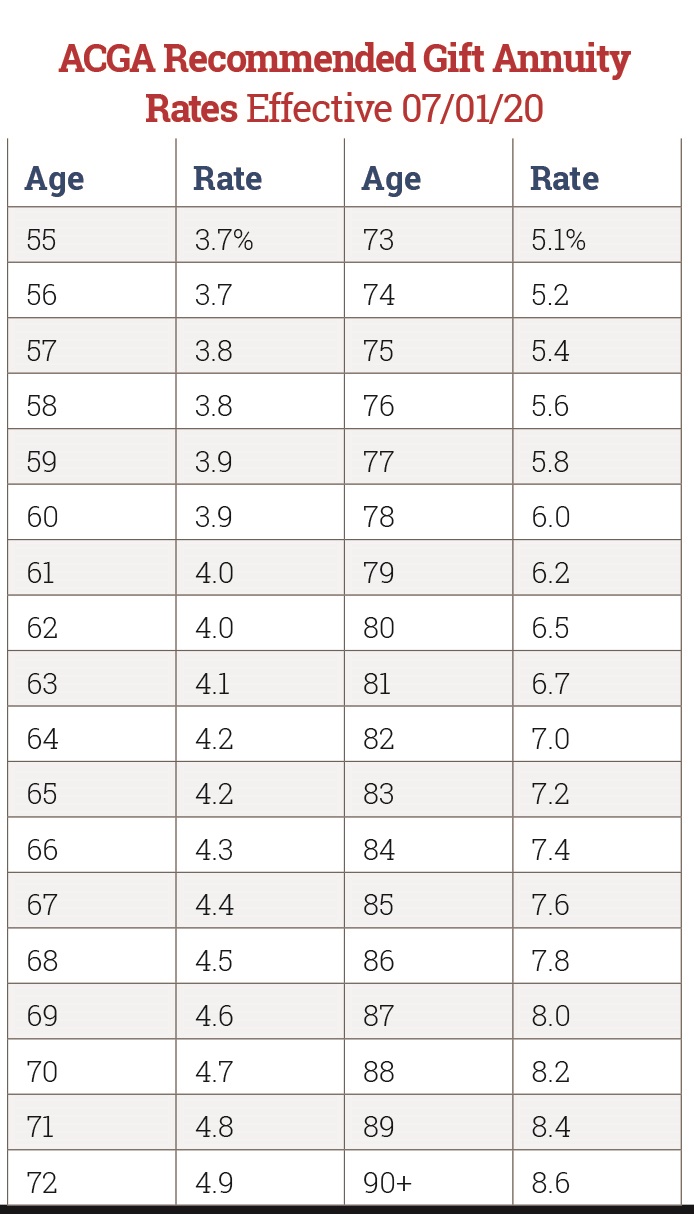

The minimum amount to start an annuity with CFNEK is 25000. Income rates are based on your age or the age of your beneficiary at the time payments commence. The minimum age to establish a charitable gift annuity with the Catholic Foundation of Northeast Kansas is 65.

At her age she will receive payments fixed for life at 58. Skip to main content. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now.

Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities. A Charitable Gift Annuity CGA supports your favorite nonprofit organization and provides a lifetime of income too. Ad Earn Lifetime Income Tax Savings.

Butler who is 75 years old establishes a 25000 gift annuity for the eventual benefit of The Metropolitan Museum of Art. You make a gift to Catholic Gift Annuity and in return you receive fixed payments for life. Many require donors to contribute a minimum of 10000 to 25000.

Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. Do Your Investments Align with Your Goals. Calculate Your Benefits Submit a few details and see how a charitable gift annuity.

What is a Charitable Gift Annuity. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of. The amount of your payments is based on your age.

Large initial tax deduction. Is a Humane Society gift annuity the right choice for you. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger.

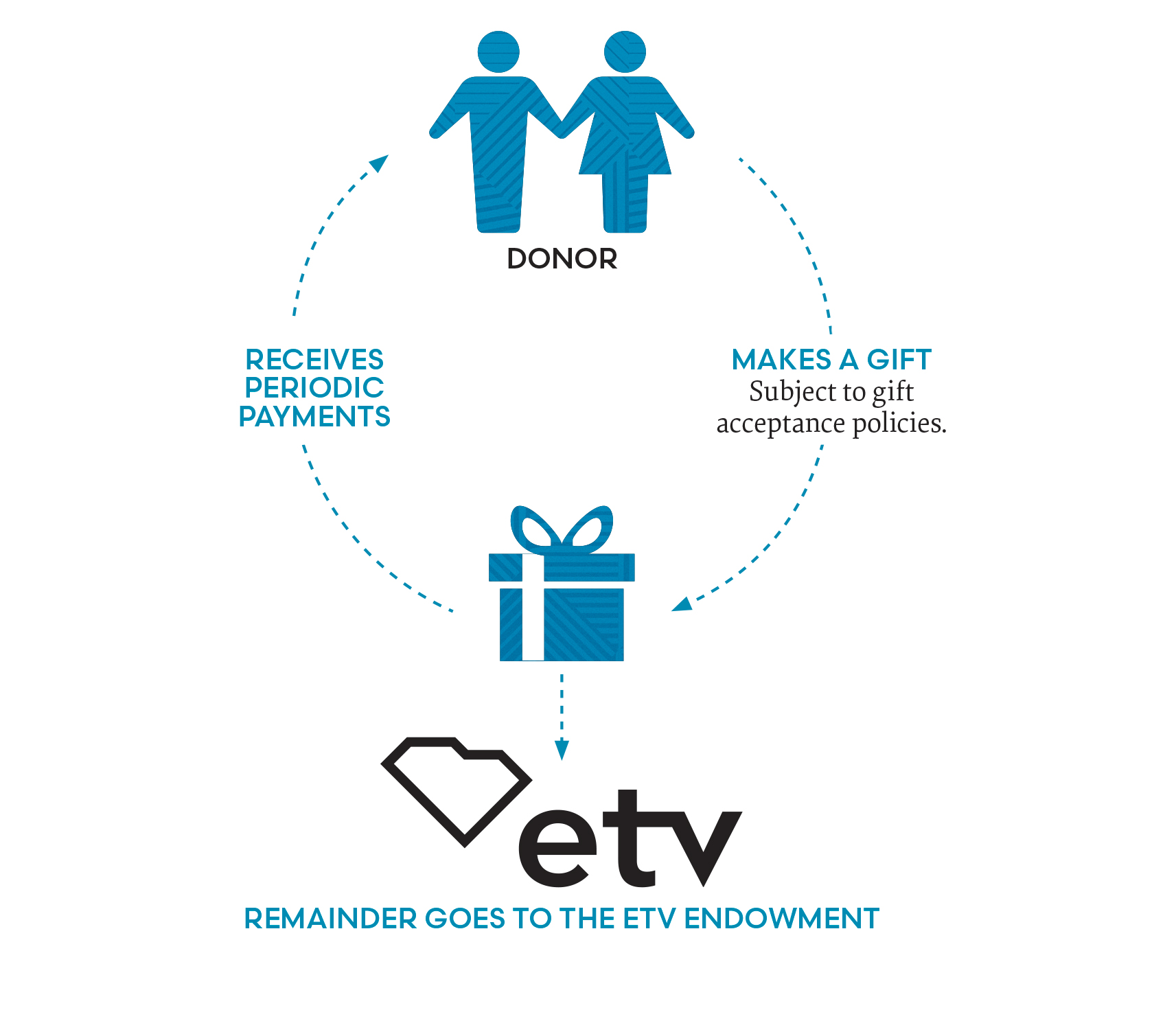

Thousands of colleges and charities raise money using gift annuities and policies vary among institutions. Charitable gift annuities make this possible. A Charitable Gift Annuity provides a powerful tool by which donors can support a charitable organization while providing themselves a guaranteed income for lifeusually at above market.

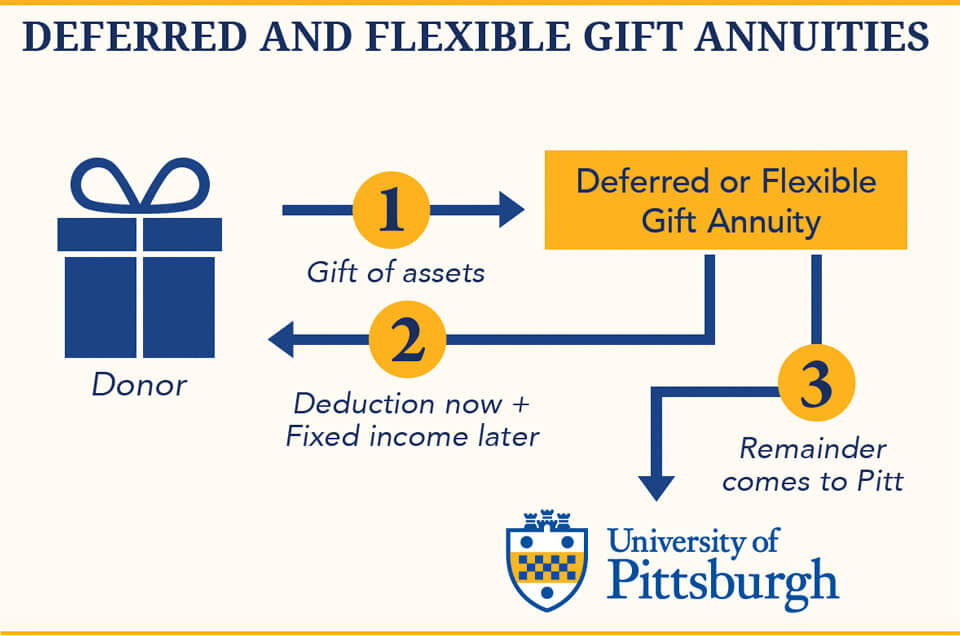

Is a Humane Society gift annuity the right choice for you. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Learn about charitable gift annuities the pros cons of this type of monthly payment for donors how they work in terms of taxation regulations. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. With Annuities You Receive.

125 rows Multiply the compound interest factor F by the immediate gift annuity rate for the nearest age or ages of a person or persons at the annuity starting date. A charitable gift annuity is a simple contract. Ad Learn some startling facts about this often complex investment product.

Future annually income partially tax free. Current gift annuity rates are 49 for donors age 60 6 for donors age. The minimum age for a charitable gift annuity is 50 and the minimum gift amount is 25000.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Fixed rate according to your age. The annuity is a contract under which a qualified public charity agrees to pay the donor called the annuitant a lifetime income in return for the irrevocable transfer of cash or.

Give Gain With CMC. Including your ages when you set up the charitable gift annuity. A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement.

Ad Support our mission while your HSUS charitable gift annuity earns you income. A Charitable Gift Annuity CGA is a giving instrument for one or two individuals that provides guaranteed fixed income for life.

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuities The University Of Pittsburgh

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuity Etv Endowment Of South Carolina

Charitable Gift Annuities Philadelphia Foundation

Acga Charitable Gift Annuity Rates

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

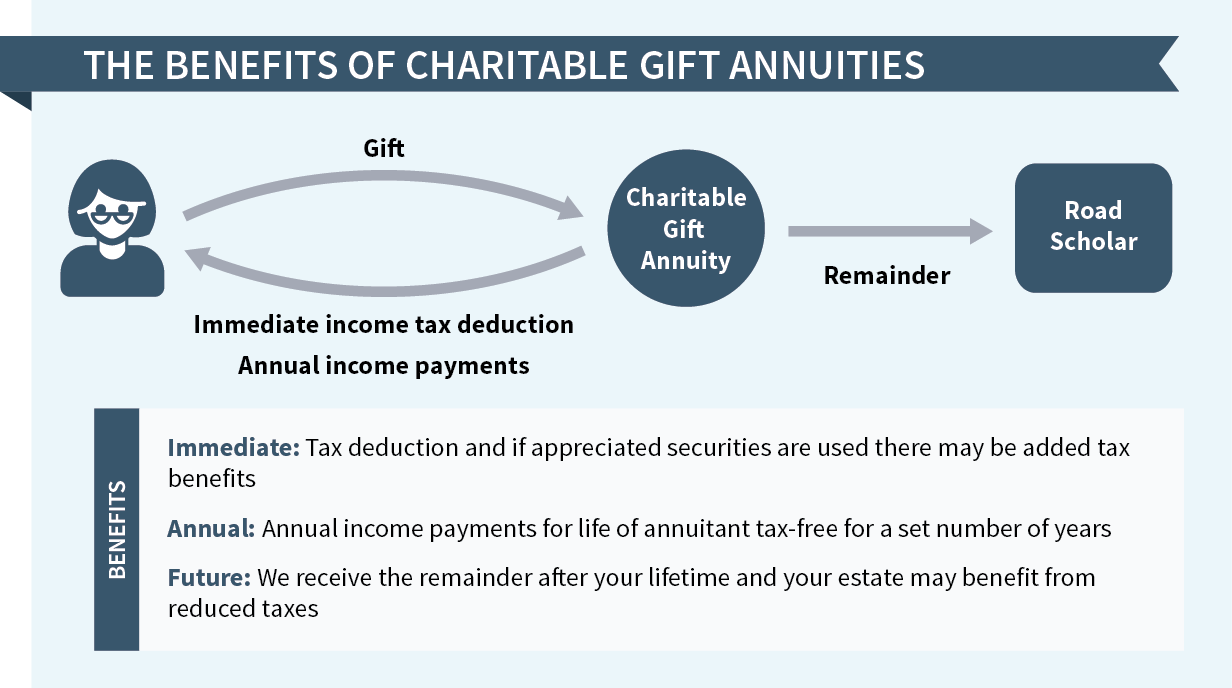

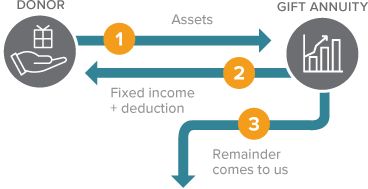

Charitable Gift Annuities Road Scholar

Charitable Gift Annuity Rate Increases Texas A M Foundation

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuities Suny Potsdam

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuity The Als Association